Forex And Cfd Contracts Are Over-the-counter (Otc) Derivatives

OTC Markets Meaning

The meaning of OTC Markets is that these are the markets where trading of fiscal securities similar commodities, currencies, stocks, derivatives, etc. and other non-financial trading instruments does not take place on recognized stock exchanges and instead takes place over the counter i.east. directly between the two parties involved, with or without the help of private securities dealers.

OTC Markets Functioning

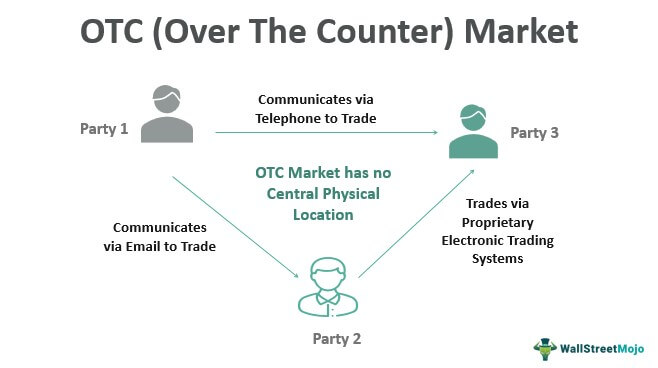

Over-the-counter (OTC) market is a decentralized marketplace and does not have a central physical location and the trade and communication between the parties involved takes place through various modes such as e-mail, telephone, and proprietary electronic trading systems.

The prices are dependent on the supply and demand in the market. The parties involved buy and sell securities at sure prices with or without the help of banker-dealers who provide liquidity by trading for their own account and matching orders internally or publishing quotes and executing with external banker-dealers. The price of securities and other non-fiscal instruments are affected by the availability of data virtually the number and volume of orders (i.e. the liquidity of underlying stock), and the timing of buy and sell orders.

In the U.s., all the brokers and dealers involved in over the counter trading must register with Fiscal Industry Regulatory Authority, Inc.(FINRA). Retail investors A retail investor is a not-professional individual investor who tends to invest a small sum in the equities, bonds, common funds, commutation-traded funds, and other baskets of securities. They often take the services of online or traditional brokerage firms or advisors for investment controlling. read more should execute their transactions (buy and sell orders) in OTCQX, OTCQB, and Pink securities with the aid of a FINRA-registered broker-dealer.

You lot are gratis to utilize this image on your website, templates etc, Delight provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: OTC Markets (Over The Counter) (wallstreetmojo.com)

OTC Markets Grouping

Formerly, over-the-counter trading was referred to equally "pink sheet Pinkish sheets are stocks that cannot be traded on exchanges such as NYSE/NASDAQ for a diverseness of reasons, including a lack of sufficient capital to go public, lack of economic justification for going public given the small amount of capital they intend to raise, or a strategic conclusion not to go public due to the scrutiny that the regulatory boards identify on them. read more " trading. But these old pink sheets take been re-categorized by the OTC Markets Group into the nowadays-mean solar day OTC Pink, OTCQB, and OTCQX.

Yous are costless to employ this image on your website, templates etc, Please provide the states with an attribution link Article Link to be Hyperlinked

For eg:

Source: OTC Markets (Over The Counter) (wallstreetmojo.com)

#ane – OTC Pinkish

The pink open up marketplace, as well referred to as OTC pinkish sheets are the most unregulated and open platform of all trading marketplaces. It does non lay whatever rules for the companies in social club to get listed here and also the companies need not file with the Securities Exchange Commission. The simply requirement is that they need to obtain quotes from a banker-dealer registered with the FIRA.

The aforementioned features of an OTC pink market provide a trading platform for domestic or foreign companies, that limit their disclosure in the U.S., penny stocks Penny Stock refers stocks of public companies that trade at a very low price, typically less than $v per share and are highly illiquid. Normally, these stocks belong to small and newbie companies with a depression market place capitalization. read more , as well equally distressed, delinquent, companies not willing or able to provide information to the potential investors.

Therefore, the investors demand to be professional and highly sophisticated with a high-gamble tolerance for trading in companies that have limited data bachelor to the public. Also, due to the express regulatory oversight, it is strongly recommended that the investors go on with great caution and thoroughly research the listed OTC pink companies that they are interested in before making any investment decisions.

#ii – OTCQB

OTCQB which hosts the Venture Market is the 2nd tier on the OTC Market Group. The companies that are listed here are mostly small and in the growth phase of their life bicycle. In guild for companies to beginning trading in the OTCQB marketplace, they are subject field to a set of regulations. The requirement to fulfill a minimum set of standards reduces the possibility of Penny stock companies and fraudulent corporations from getting listed in the QTCQB marketplace.

The companies trading hither are open natured and are less transparent than their established counterparts and so this poses a threat to the investors who conduct trades without investment acumen. The investors are therefore advised to exist diligent when investing their capital in the companies listed on the QTCQB market.

#3 – OTCQX

The OTCQX which belongs to the highest tier in the OTC Market Group includes multinational corporations, stocks of blue-chip companies Baddest stocks refer to the stock of large stable companies having market capitalization in billions that provide a good return on stocks, may provide dividends, have less risk and are considered to be safe investments. Examples of such stocks include Coca-Cola ltd, IBM Corp, Boeing Co., PepsiCo, General Electrical (GE), Intel, Visa, Wal-Mart, IBM Corp, Apple, Walt Disney, Mc Donald's, Goldman Sachs, Johnson & Johnson, etc. read more than , and groups that are required to evidence their integrity to investors. In order to go listed on the OTCQX, companies must go through stringent disclosure requirements. The companies of the OTCQX must fully comply with laws put forth by the U.s.a. Securities Exchange Committee. These stringent policies safeguard the interests of the investors equally penny stocks are excluded.

Although the listed companies undergo strict scrutiny, trades remain private. Due to the decentralized nature of the OTCQX, there is scope for speculative investments and these investments are therefore considered to be a little risky. Despite the level of risk, many investors enjoy incredible returns in the OTCQX.

Information technology is to exist noted the amount of risk is far less than the other ii marketplaces. Here, the companies would undergo verification that is very like to what they would confront with a recognized stock substitution.

#four – OTC Link

The OTC link is a service owned and operated past the OTC Markets Group and provides a link for traders and companies on each of the three marketplaces discussed above. OTC Link acts as a connexion for any visitor looking to merchandise on an OTC Market Group network. Quotes i.e. ask and bid prices Bid Toll is the highest amount that a buyer quotes against the "ask price" (quoted past a seller) to buy particular security, stock, or any fiscal instrument. read more are obtained or published from a arrangement maintained by the Over The Counter Markets group.

Advantages

- OTC markets are decentralized and so they allow for the free trade of securities between parties involved without the interference of exterior parties.

- The traders in the OTC markets are gratuitous to set the prices and the banker deals on their own.

- OTC provides access to securities or stock non available on standard exchanges.

- OTC markets impose fewer regulations.

- Penny stock companies and other small companies that don't go listed on recognized stock exchanges tin go listed in the OTC market place place.

- The investors pay less trade costs so they can achieve a pregnant level of return.

Disadvantages

- There is a greater risk of fraud due to the lack of regulation.

- The prices of the securities or other not-financial instruments are highly volatile.

- OTC markets pose a threat of low liquidity.

- There can be delays in finalizing the trade.

- OTC markets lack transparency.

In a nutshell, OTC trading is an unregulated grade of a trading organisation that promotes equity and thereby helps the investors in trading in those stocks that would otherwise non exist available on the standard exchanges.

Recommended Articles

This has been a guide to OTC Markets and its pregnant. Hither nosotros discuss the pinnacle 4 over the counter market group forth with its functioning, advantages, and disadvantages. You can learn more from the following articles –

- VBA Counter

- Distressed Sale

- Share Market place

- Forwards Charge per unit Understanding

Source: https://www.wallstreetmojo.com/otc-markets-over-the-counter/

Posted by: kumarspold1985.blogspot.com

0 Response to "Forex And Cfd Contracts Are Over-the-counter (Otc) Derivatives"

Post a Comment