Average Daily Range Forex Indicator

The ADR indicator:

profit in the marketplace beat out

A multifactor mechanism of the financial markets, that seems to exist very complicated externally, is as well subjected to the elementary laws of statistics. Each trading business relationship is a office of a huge money flow and to understand the overall movement, a trader is obliged to utilise any average value correctly.

The ADR indicator (Average Daily Range) calculates the near of import value − the average daily price range for the selected financial nugget.

Patently, this indicator was developed by the intraday trading enthusiasts: you are offered an automatic «calculator» for analyzing the average volatility for a flow, which allows to solve the main issues of the short-term trading − determining the optimal entry/exit points.

Then let's begin.

Logic and purpose

Correct assay of volatility is an extremely important element of any trading strategy. Insufficient attending to the market activity leads to an incorrect installation of the Take Profit/Terminate Loss orders, that is − either to losses or losing a potential profit.

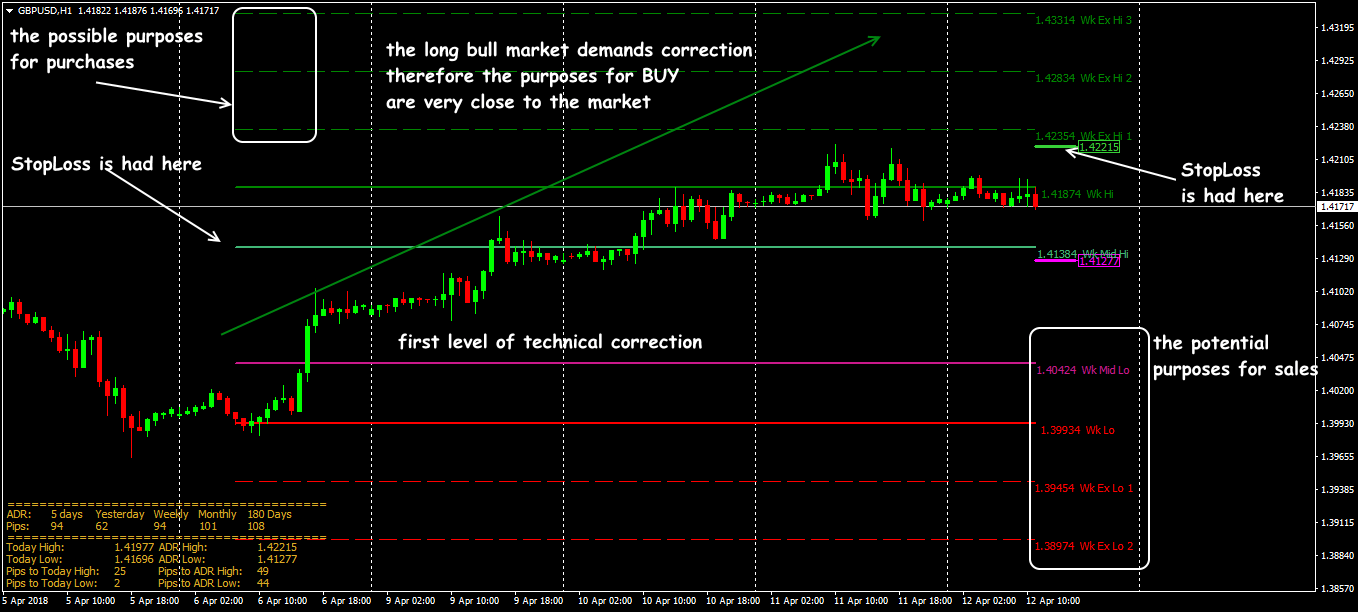

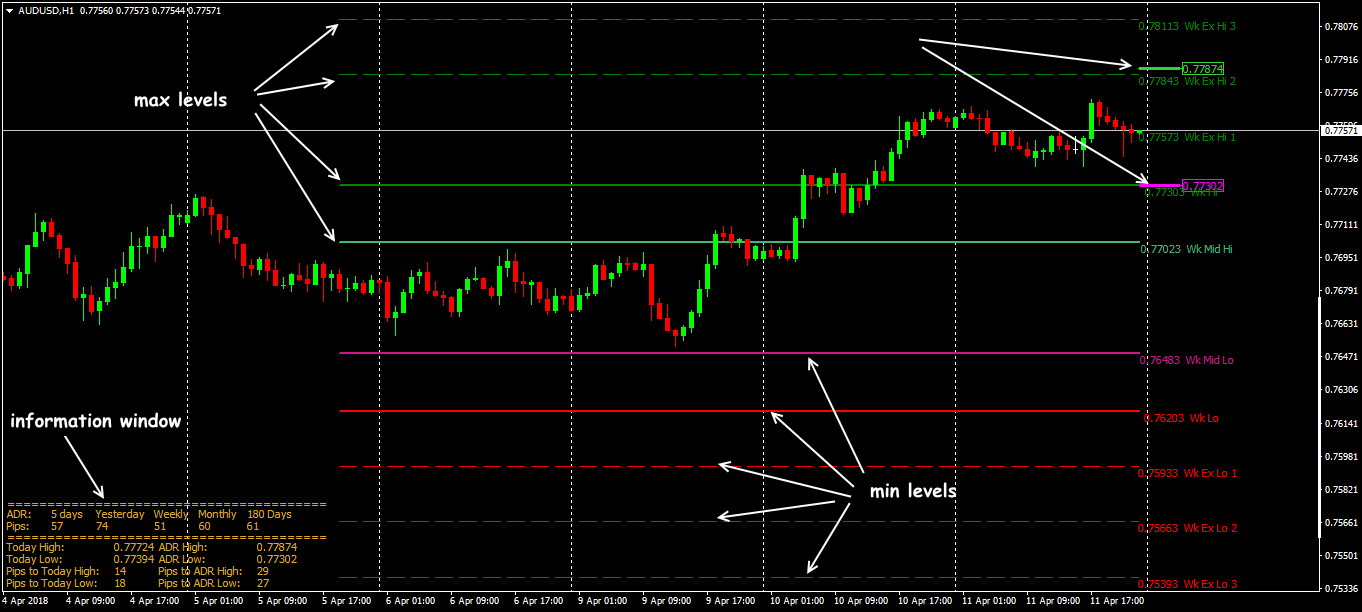

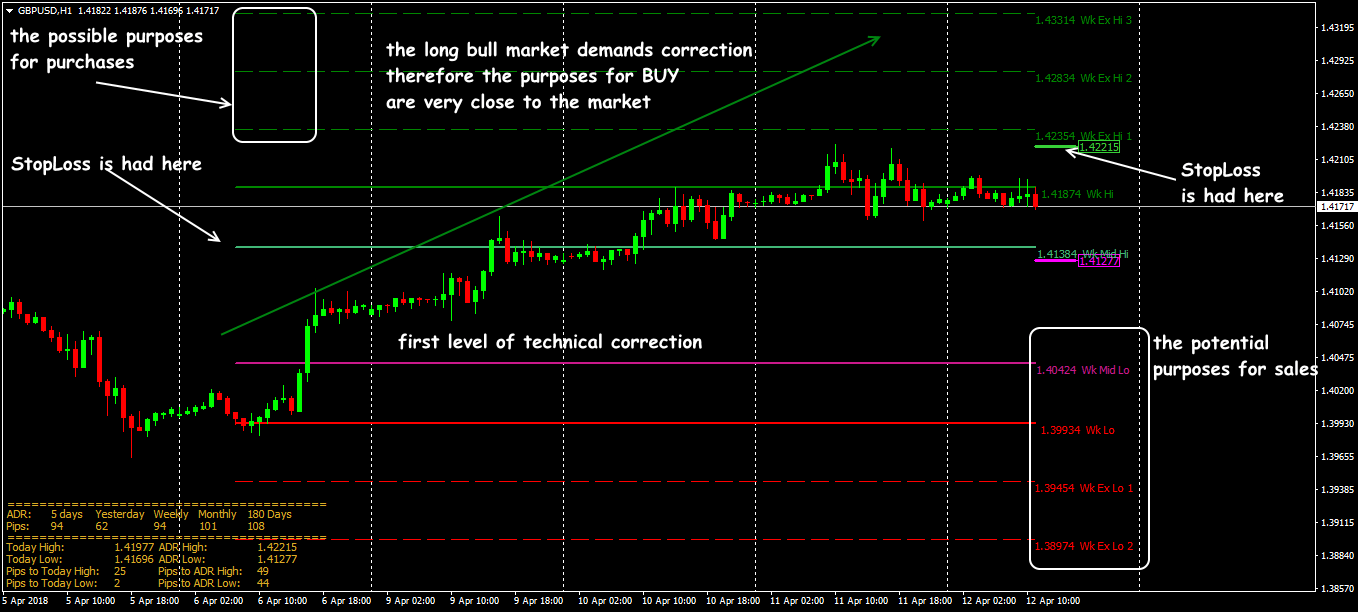

The Average Daily Range is represented by «reasonable», statistically justified price boundaries, in which the market move is highly expected − this allows choosing the right trade tactics in a zone of the strong price levels (Average Daily Range).

In fact, the ADR indicator shows changes in the price values per unit of fourth dimension (for example, for medium-term and intraday methods, the D1 timeframe is usually used) and solves the following tasks:

- automatic calculation of trading ranges for a trading day, week, calendar month;

- determination of potential levels of the marketplace demand/supply (support/resistance);

- determines the farthermost price points (max/min).

Let'south run into exactly how it works.

Adding process

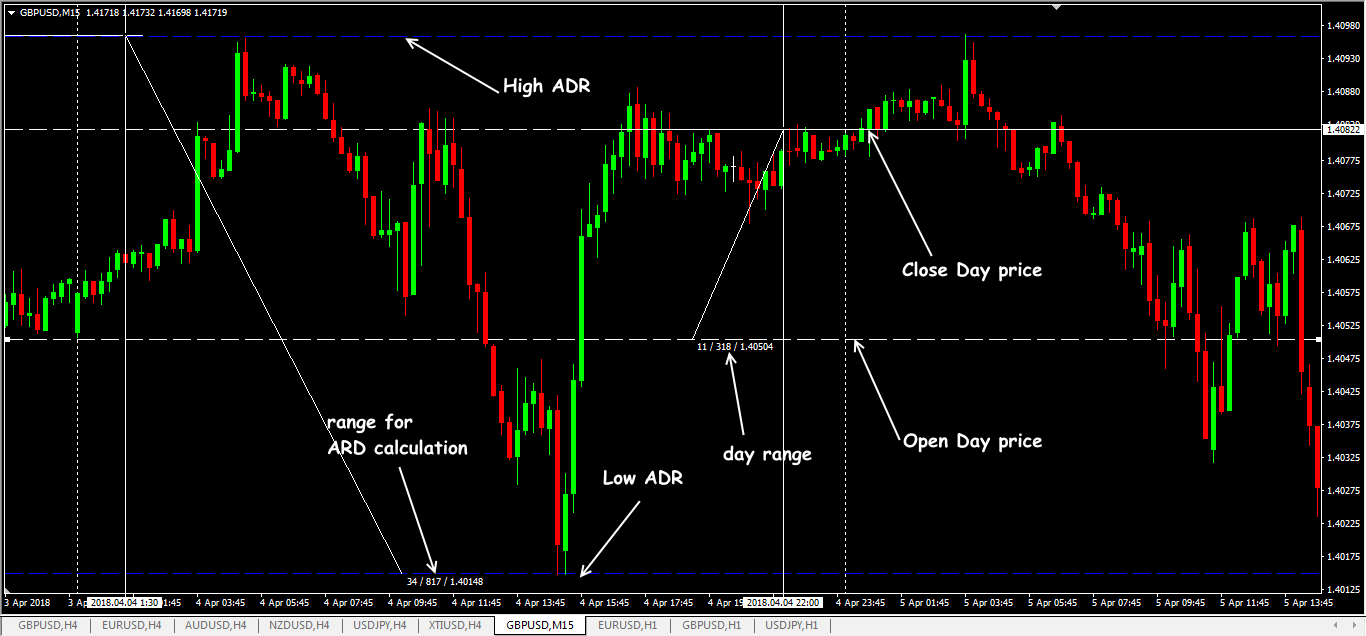

The average price range is a value that the price has passed from min to max within one trading twenty-four hours. The result of calculation is displayed in the trading terminal window in a separate information board.

Reminder: this range is not equal to the distance between the opening and closing prices of the trading day!

ADR is calculated as the Average Daily Range (the difference between loftier toll and low cost values of a day bar) for the selected menstruation (come across Average Daily Range). For example, if you want to determine the value for a week, then summate the sum of the data for each twenty-four hours of the week, and split up by the number of trading days:

The consequence is obtained in toll points. The aforementioned calculation machinery is practical to any other menstruum.

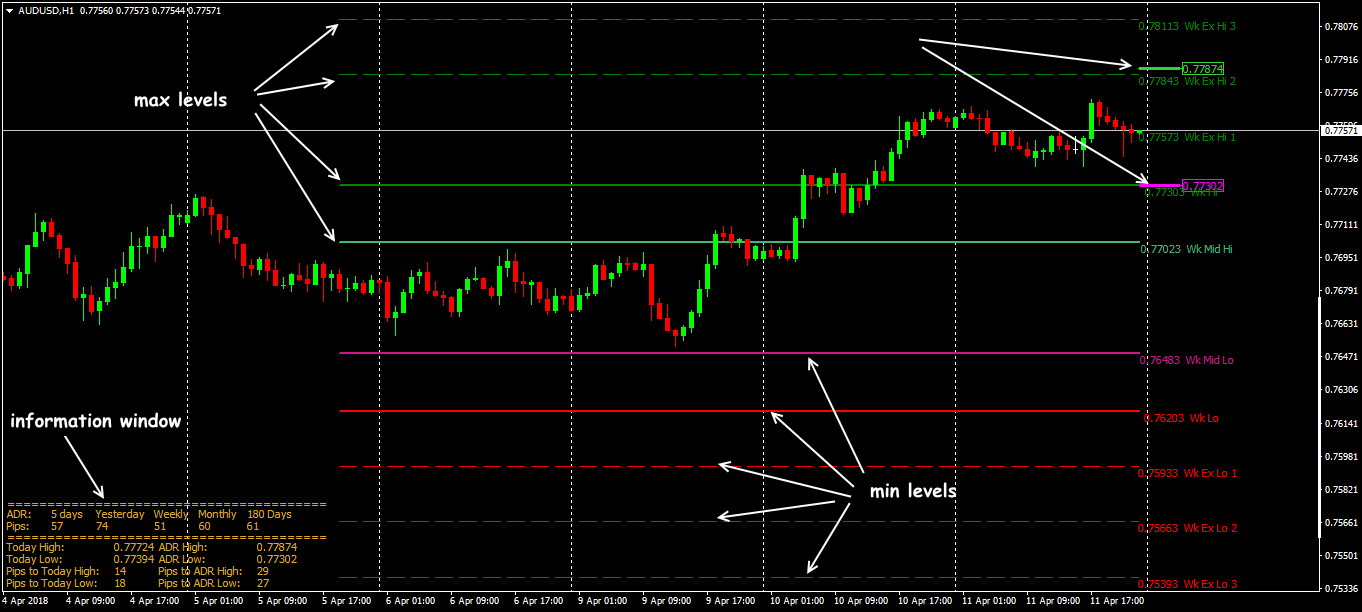

Borders of the ADR range

In addition to the two main ADR lines, after the adding on the price chart (depending on the parameters − read below), several boosted price levels are displayed. They are as well calculated on the ADR principle.

The subsidiary WeekHi level is the sum of ADR for the week and the last Fri'due south closing price; similarly, the WeekLo level is calculated every bit the difference between ADR for the week and the last Fri'south endmost price.

If the sum of ADR for the week and ADR for the month is divided by 4, and then the final Friday'south endmost price is added, then nosotros become the WeekMidHi level. If we minus this value, we become the WeekMidLo level.

The remaining levels are constructed additionally at the distances equal to the departure betwixt (WeekHi − WeekMidHi) and (WeekLo − WeekMidLo).

The post-obit levels are calculated with the aforementioned interval. There is no special fundamental logic in these calculations, but they have been approved past many years of practice, and this is a serious argument.

Parameters and control

In almost pop trading platforms, the ADR indicator is not included in the standard bundle, merely its diverse versions tin be freely institute online.

Let'due south consider the well-nigh popular and «visually» correct variant.

Standard version of the Average Daily Range indicator

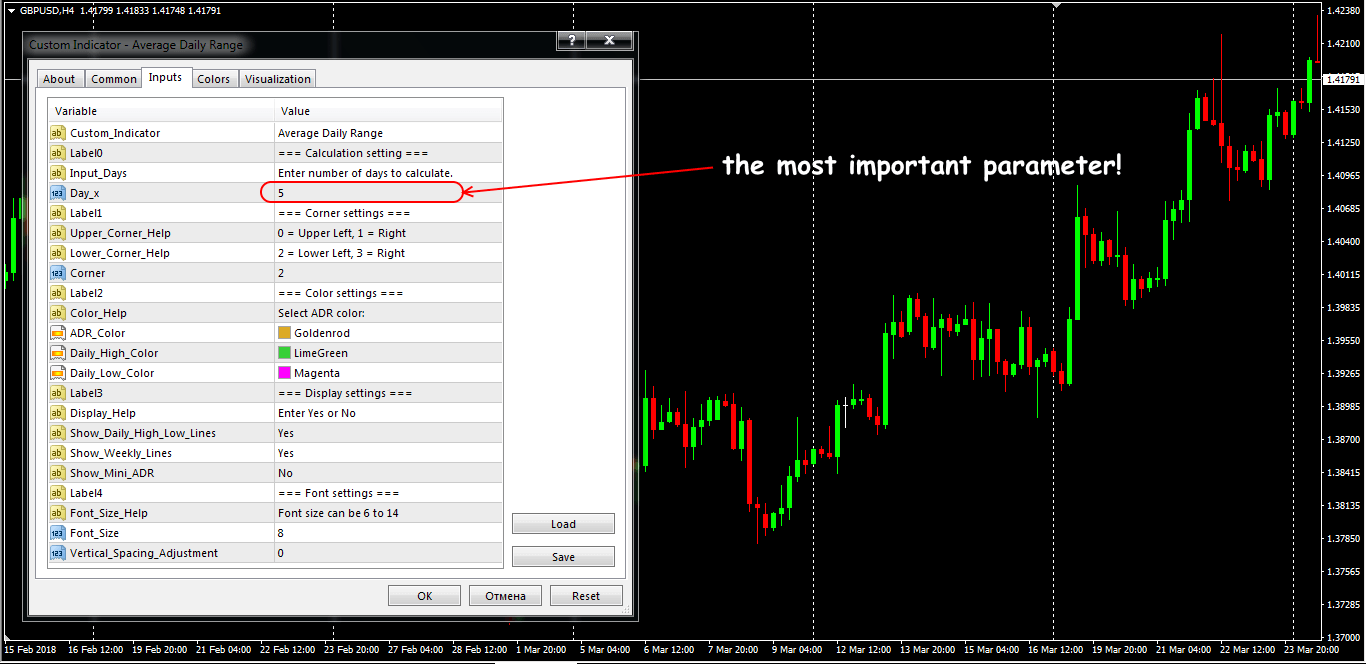

So, the basic parameters of the ADR indicator:

- Day_x: the number of trading days for the adding;

- Corner: location of the information window on the working screen (0 − upper left corner, one − upper correct corner, two − bottom left corner, 3 − lesser right corner);

- ADR_color: the text color of the data window;

- Daily_High_Color: color of the Hi ADR mark;

- Daily_Low_Color: colour of the Low ADR marking;

- Show_Daily_High_Low_lines: enables/disables the display of the boundaries of the High/Low day range («Yes» past default);

- Show_Weekly_Lines: enable/disables the display of the boundaries of the calendar week range («Yes» by default);

- Show_Mini_ADR: minimization of the information window («No» past default);

- Font_Size: size (from 6 to fourteen) and Vertical_Spacing_Aquiment the line spacing for a font in the data window.

Actually, these settings exercise not influence the calculation mechanism. Settings for the visual brandish («Yes»/»No») are entered manually.

The result?

Basic levels of Boilerplate Daily Range

If it seems to you lot that the indicator's levels «encumber» the cost chart visually, then it is possible to disable the display of the lines, and keep only the information window (cheque Using Graphic Tools).

In the information cake, the results of adding can be constitute (in cost points):

- daily (see parameter Day_x);

- for the previous day;

- for the week;

- for the previous 6 months;

- Loftier and Low prices of the electric current twenty-four hours;

- distance from the electric current price level to the current max/min;

- calculated values of the ADR indicator;

- distance from the current price to the calculated High/Low values of ADR.

How to employ all this in the real trading − allow's look at it in detail.

Trading signals of the indicator

In practice, the ADR indicator doesn't generate obvious signals for the entrance to the market place; utilise of this tool comes down to restriction of the Take Turn a profit size or to the Stop Loss adjustment (bank check here Using Indicators).

All merchandise ideas are based on the ordinary logic of behavior in a zone of strong price levels: it is considered irrational to sell if the price is near the min range (chapters of the price motion is strongly limited). The similar dominion works for the max value of the twenty-four hour period range – probability of the further growth is too small-scale.

Trading signals of the Average Daily Range indicator

Reminder: The ADR range borders do non necessarily coincide with the Pivot levels! Breakup on a trend (every bit a rule, with the subsequent rollback) and a reversal in the ADR expanse are equally possible events, from the bespeak of statistics.

Exercise shows that for the main currency assets, the H1-H4 period volition be the almost adequate. The ADR values tin can be used for more exact determination of the target levels in whatsoever strategy with a menses of retentivity of the open up trades that lasts from one day to one week.

Incorrect Average Daily Range levels

For the correct piece of work on the ADR levels, a not speculative, rather predicted market is necessary. All such strategies apply the upshot of averaging and therefore they should be checked previously on the historical data.

Application in the trade strategies

There is no special and «super profitable» trade strategy for the ADR indicator – after all, it is an auxiliary technical tool (A Unique Way to Use ADR to Your Reward).

Of course, information technology is like shooting fish in a barrel to give an advice, merely from the point of view of the primal analysis, the Average Daily Range boundaries aren't the authentic back up/resistance levels. Every bit a result, information technology isn't recommended to merchandise in a reliance on the firm breakup of these lines.

Nonetheless, the use of ADR allows to calculate the size of a potential Take Profit/Stop Loss benefit, taking into business relationship historical and current volatility of the asset. As an case, nosotros volition give a technique that is especially popular among scalpers:

Breakdown of the morning flat

Considering of the fact that American and European exchanges are closed during the Asian («nighttime») Forex session, market volumes are weak, and an active motion on the main currency pairs begins with the opening of trading floors in Europe.

It is the time when the volatility begins to increase. Information technology defines the direction of motility, at least, till the middle of the European session or till the moment when the statistic on EUR, GBP, CHF appears.

Awaiting orders on the ADR range boundaries allow to have 10-12 (and even more) points of a profit.

However, modernistic analysts recommend «to catch» such a moment when the trading in the Chinese market place is already endmost, especially during the periods of expiration of the futures contracts or large options on the Asian stock exchanges.

In that case, the ADR indicator can be used as an additional filter while setting out the Asian session range, as well as for definition of the profit purposes, for example:

ADR: Trading signals scheme of the «Breakdown of apartment» strategy

What this means is:

Nosotros place Take Profit several points above/below the ADR levels because information technology is a daily average range and the deviations in both sides are probable enough.

If the first pending order has fulfilled the minimum turn a profit and the short-term consolidation begins, then it is possible to put the Limit-order to the opposite side («on the rollback») with the purposes in a zone of the second purlieus of the ADR channel.

If any of the established pending orders hasn't been opened within a trading day, so they need to be cancelled. The side by side mean solar day, it is recommended to put new positions taking into account parameters of endmost of a day candle.

Reminder: we don't put awaiting orders for the breakup and we don't enter the market at all if the current price is too close to the calculated borders of the ADR aqueduct! We don't purchase almost the pinnacle boundary and we don't sell near the bottom boundary of the range.

Several applied remarks

Information technology is necessary to command the moments of the strong news and to correct your trading purposes taking into business relationship the current trend (check How to Decide Average Daily Range Day Trading Futures).

In that location are situations when the average daily range of ane-2 previous days strongly differs (lags backside or exceeds) a calculated value for the current period. In that case, yous tin hope that the market «volition grab upward» with an «ordinary» ADR value during several trading sessions.

Thank you to the simple mathematics, the ADR indicator shows the most probable ranges and price reference points which is peculiarly important for the medium-term strategies. It tin can exist used on any timeframe and any trade asset – it will exist equally useful.

Was this article useful for you? Information technology is important for united states of america to know your opinion – share your comments downwardly below!

Try It Yourself

Subsequently all the sides of the indicator were revealed, it is correct the time for yous to endeavour either information technology volition become your tool #1 for trading.

In order to try the indicator performance alone or in the combination with other ones, yous can use Forex Tester with the historical information that comes forth with the programme.

But download Forex Tester for free. In addition, you volition receive 21 years of free historical information (easily downloadable straight from the software).

Share your personal feel of the constructive usage of the indicator Alligator. It is important for the states to know your opinion.

What is your favorite indicator?

Source: https://forextester.com/blog/average-daily-range-indicator

Posted by: kumarspold1985.blogspot.com

0 Response to "Average Daily Range Forex Indicator"

Post a Comment