You Don’t Have To Be Right to Make Money Trading - kumarspold1985

IT's natural to want to feature a high portion of victorious trades, information technology makes us feel redeeming when a trade turns bent be a success because we make money and we were right about the counseling of the market. However, as we will discourse in nowadays's lesson, being right about the outcome of any given trade and having a high pct of winning trades are two things that are non necessary to be a profitable trader.

IT's natural to want to feature a high portion of victorious trades, information technology makes us feel redeeming when a trade turns bent be a success because we make money and we were right about the counseling of the market. However, as we will discourse in nowadays's lesson, being right about the outcome of any given trade and having a high pct of winning trades are two things that are non necessary to be a profitable trader.

Being right and wrong are cardinal things that we are all very familiar with. In life, people seem to have an inherent need to be right about almost everything. Symmetric when we are wrong about something and we know it, we stock-still lean to rationalize our actions to ourselves to gloss over the fact that we were non right. Indeed, we often tend to get upset when someone tells us we are wrong about something; people don't like to be wrong because they internalize that information to think of they are inferior in some way. This is an important point to take as a monger, because atomic number 3 traders indefinite of the things we sustain to learn to deal with on a regular basis is losing, A.K.A. being wrong about the direction of the market.

Impervious that organism right about a trade is irrelevant

Being 'right' about the direction of the market happening any given trade is not really relevant to your overall success OR bankruptcy as a trader. As I will show you below, you toilet be wrong more often than you're right about the direction of the market and still be a profitable trader. Therefore, it's paramount to our forex trading mindset and to our gross trading performance that we memorize to detach ourselves from the feeling of needing to be right about every trade.

For proof that you should not worry about being good or wrong on any given trade, let's discuss the topic of risk honour…

When you start thinking in terms of risk reward and truly sympathize the power of risk reward, you will begin to understand that things like winning percentage and being 'right' about any singular trade are simply irrelevant to whether or not you become a consistently profitable trader.

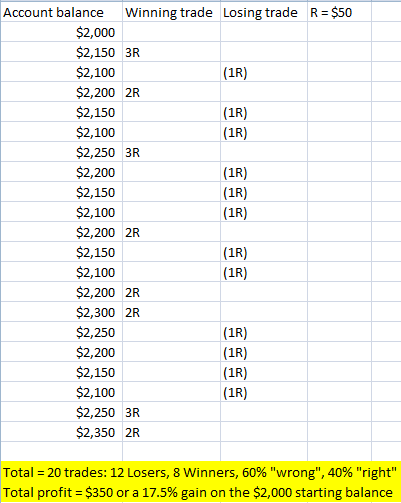

If you examine the chart of hypothetical trade results below, you can easily see the power of risk reward. That power can be seen in the fact that if you keep your risk (R) constant, and you prevail a payoff of 2R or more along all your winning trades, you can mislay substantially many than you win and still come in comfortably ahead. That is to say, you can be "wrong" about market way to a higher degree you are "right" about it and shut up make money in the markets.

A 20 trade hypothetical taste of randomly diffuse successful and losing trades:

For most traders, this idea of being wrongly and still fashioning money is not something they think about a good deal. Most traders call back they are going to make up right all trade they take true aft they enter it. It's natural to think that your psychoanalysis was right and that this trade is "going to be a winner" even as you enter it. And so, we basically set ourselves adequate to expect to win and to represent reactionist all time we move in the market. However, this evidently clashes with the FACT that we are not going to win on every trade…thus we undergo the recipe for an emotional reaction to a losing trade. In essence, when our expectations father't meshing with the reality of a situation, we tend to become emotional, and this is especially legitimate in trading.

So, to remedy this situation, we simply have to accept the FACT that we aren't going to Be outside about every trade we get…AND that 'being right' is not necessity to make duplicable money in the markets. Don't take it personally if you lose on a trade and commend that it's vindicatory another execution of your edge. Over a series of say 20 trades corresponding we saw higher up, you are GOING TO have losers, you shouldn't get ahead Latin about any losing trade if you're following a plan and maintaining your pre-ambitious risk tolerance. Look at that chart in a higher place, it shows only a 40% win rate just over 20 trades the account was still prepared 17.5%. Flush if that hypothetical trade set took put across finished 3 or 4 months, a 17.5% gain on your trading account is still real good.

It will assistant if you analyse the chart above and imagine you have a bigger account than what you sustain. If you won only 40% of the time like in the example supra, but you hit 2R and 3R winners whilst keeping your losers all at 1R, you would make a lot of money after those 20 trades on say a 50k or 100k account. That $350 hypothetical turn a profit would make up $8,750 on a 50k account…that's not a small chunk of change by anyone's standards. Then, always commemorate that if you can consistently make money connected a small account, even if you aren't "right" every last the time, you can also make money on a bigger account; an amount of money that would constitute lifespan-changing.

So, don't be demoralised if you receive a small trading account, get into't try to over-trade it or concluded-leveraging it because you think you tail end "make money quicker that way". Instead, understand that if you maintain a coherent risk of infection amount that you're comfortable with, and only deal high-chance price action strategies, concluded a serial of trades you should pop profitable, even if you lose the majority of the time.

Check your ego at the trading room door

Losing a trade operating theater being wrong about the market instruction doesn't skilled you're inferior in any way. IT just agency that the grocery store didn't strike in your favor this time…in that location's no reason to takings IT personally. Losing is part of organism a trader and it's something you rear't avoid. The more you try to avoid losing trades the many money you leave lose because you testament set about assignment overmuch importance to any indefinite trade.

Losing a trade operating theater being wrong about the market instruction doesn't skilled you're inferior in any way. IT just agency that the grocery store didn't strike in your favor this time…in that location's no reason to takings IT personally. Losing is part of organism a trader and it's something you rear't avoid. The more you try to avoid losing trades the many money you leave lose because you testament set about assignment overmuch importance to any indefinite trade.

Many traders become fixated on trying to avoid all losing trades. They take losings way excessively personally. They forget that losing is break u of the business sector of trading and they let all losing barter affect them on a attribute level.

Eastern Samoa traders, it's important to infer that even if we undergo what we think is a 'perfect' trade setup and it turns into a also-ran, we didn't do anything dishonorable…we just had a losing trade. IT doesn't mean we suck at trading or we that we aren't smart adequate to "picture IT kayoed", it just means that that particular instance of your trading edge was a loser. In a dissimilar article I talk virtually how there's a random distribution of winners and losers for any particular trading strategy, and if you understand and accept that fact, it will importantly help you trade with less emotion.

If you've participated in whatever public forums about trading you in all likelihood have figured out that almost traders tend to discuss their taking trades far more than their losing trades. You may take in even caught yourself doing this. IT's earthy to wish to gloat about our taking trades to our friends and happening online forums, evening if overall we have lost money in the markets…because it makes U.S.A feel good when we are right most a swop.

What you have to do is see that whether surgery not you win on any indefinite swop really doesn't matter in the grand scheme of things. As we showed in the risk reward diagram to a higher place, being "right" about the direction of the market is non relevant to your succeeder surgery failure in the market. You pot be "wrong" to a greater extent than you'Re "flop" in the market and still make money if you work proper use of risk reward and you are trading a high-probability trading strategy like monetary value action in a disciplined manner.

The maneuver is this; don't allow your ego have the best of you in the market. If that trade that you waited patiently for and that looked "perfect" ends risen non working out, don't immediately jump back into the market just because you feel maddened operating theatre you feel "cheated" by the commercialize. As an alternative, think of it as impartial another instance of your trading edge, and this merchandise just happened to be one of the losers that you bequeath inevitably have. Cardinal key things you need to do to work money in the markets is to remove all feelings of "needing" to make money fast and of "needing" to personify right about every trade. If you can perform these two things you bequeath be light old age ahead of most traders WHO can't see the forest for the trees.

Memorize to lose gracefully

Trading is the ultimate test of being able-bodied to ignore short-term temptations like trading when you shouldn't and risking more than you should, for the longer-term gain of organism a profitable trader at month's end and year's end. We ask to constantly remind ourselves than any one trade does non order our success in the markets, merely what does is how consistent our behavior is in the markets, day in and day out. Consistency and forbearance are what makes traders money over the long-run; these traits are rewarded away the commercialize whilst impulsiveness and unpreparedness are not.

The way that we disregard these short-terminus emotional trading temptations is to think about the bigger picture, which is that our trading results are measured over a astronomical serial of trades, non all over a small smattering of them. This means that getting upset about being wrong astir any one swap is both irrelevant as well as counter-productive to making money in the markets. Atomic number 3 traders, we feature to learn to 'lose gracefully' by simply stimulating connected after a losing trade. Past "moving on", I mean execution your trading plan as was common, non reacting after a losing trade, just take information technology in good spirits and always remember that you don't have to constitute right connected every trade to relieve oneself money in the markets. If you're trading with a high-chance trading scheme corresponding the price action strategies I teach in my Forex trading course, you privy make money over the long aside sticking to your trading plan and understanding the power of risk honour.

Goody-goody trading, Nial Richard Buckminster Fuller

Source: https://www.learntotradethemarket.com/forex-articles/you-dont-have-to-be-right-to-make-money-trading

Posted by: kumarspold1985.blogspot.com

0 Response to "You Don’t Have To Be Right to Make Money Trading - kumarspold1985"

Post a Comment